BACKGROUND

The Investor Protection Fund (Fund or IPF) is a creation of the Securities and Exchange Commission of Zimbabwe (SECZ) and was established in 2010, initially in terms of Section 4(1)(a) of the original Securities Act [Chapter 24:25] read with Clause 8 of the 1st Schedule and Clause 2 of Part II of the 2nd Schedule of Statutory Instrument (S.I) 100 of 2010. At inception the Fund was under the management of a Board of Trustees and was entirely under the purview of SECZ until the 30th of August 2013 when the Securities Amendment Act (Number 2) of 2013 became law establishing the Fund as a separate legal entity managed by a Board of Directors (Board).

Sections 86B and 86C of the Securities Amendment Act (Number 2) of 2013 established the Fund and the Board, respectively.

PURPOSE OF THE FUND

The purpose of the Fund is to provide compensation to protected investors for losses suffered as a direct result of a licensed contributor to the Fund being unable to meet their liabilities through insolvency, malpractice or other cause.

According to S.I 83 of 2017, which sets out the Rules of the Fund, protected investor means:

- a holder of a security which is dealt with by a contributor; or

- a person for whom a contributor holds a security; or

- a person who has a right, whether vested or contingent, to obtain a security from a participating firm.

GOVERNANCE

The management of the Fund is vested in the Board. The Board consists of six non executive Directors, with diverse competencies, appointed by SECZ as per section 86C of the Securities Amendment Act (Number 2) of 2013. Current Board members and the institutions they represent are listed below:

| Name of Director | Institution Represented |

| Mrs. Justice Vernanda Ziyambi (Retired)* | Judiciary |

| Mr. Anymore Taruvinga | Securities and Exchange Commission of Zimbabwe |

|

Mr. Thomson Masvaure |

Ministry of Finance and Investor Promotion. |

| Mr. Justin Bgoni | Zimbabwe Stock Exchange |

|

Mrs. Sandra T. Musevenzo |

Zimbabwe Association of Pensions Funds |

|

Ms. Thandiwe Shonhiwa |

Southern Trust Securities (Private) Limited. |

*Chairman of the Board

Main functions of the Board include:

- Administering the Fund.

- Levying contributions from contributors.

- Evaluating and paying claims made by protected investors and acting with impartiality in respect of all claims presented to the Board.

- Ensuring that the investing public is aware of the Fund, its benefits and any changes in regulations.

For the Board to execute its mandate properly the following committees were established:

- Audit and Risk Committee

- Investor Education and Awareness Committee

- Investments Committee

The Board and its committees meet at least once quarterly to deliberate on the business of the Fund.

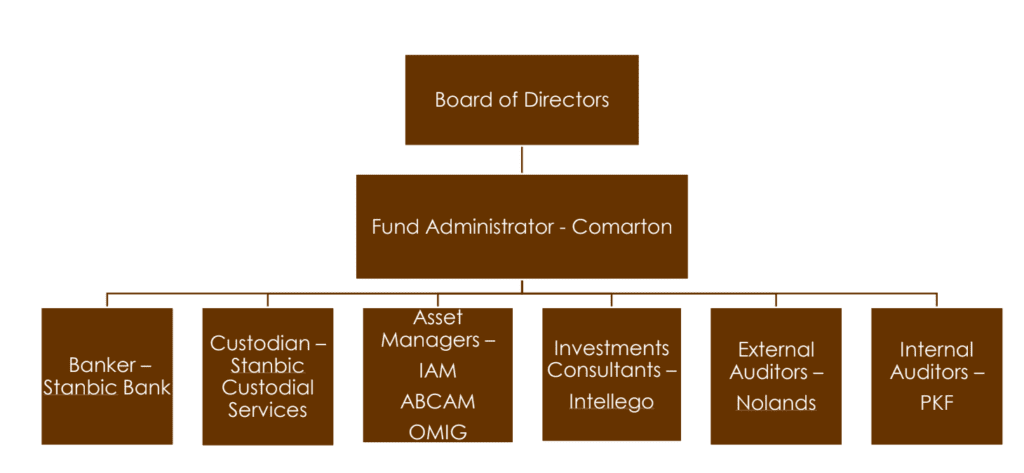

Administrative Structure:

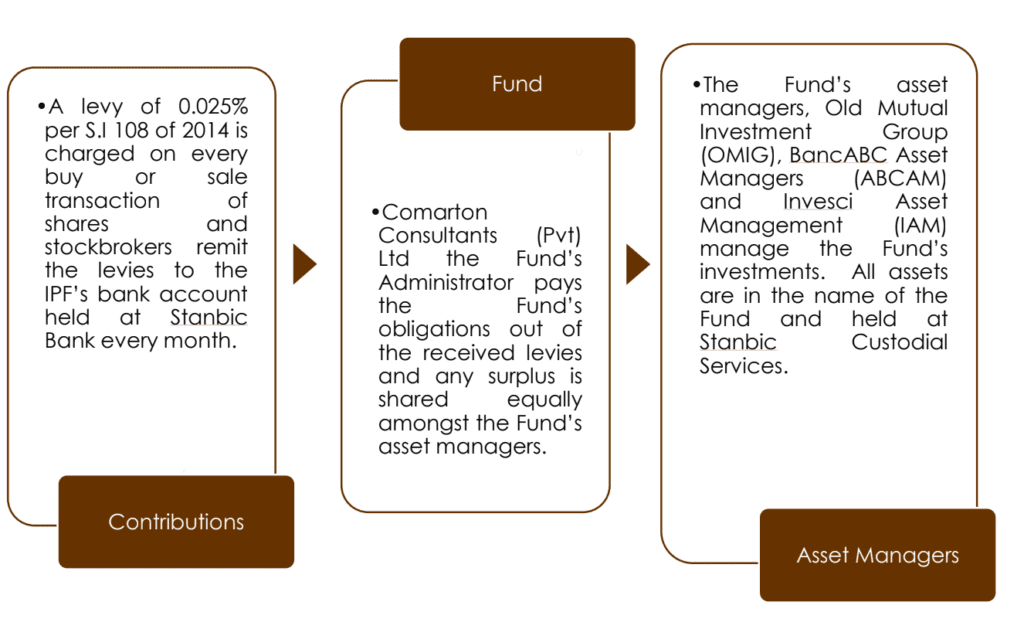

The Fund does not have a fulltime secretariat and as such all services necessary for the smooth running of the Fund are outsourced. The investments of the Fund are under the management of three asset managers namely, ABC Asset Management (ABCAM), Old Mutual Investment Group (OMIG) and Invesci Asset Management (IAM). Intellego Investment Consultants monitor the work of the asset managers to ensure they adhere to prescribed policies. The assets of the Fund are registered in the name of the Fund and are kept at Stanbic Custodial Services. Accounting, administration and secretarial services of the Fund are provided by Comarton Consultants (Private) Limited. Other Fund Officers include Nolands Harare Chartered Accountants and PKF Chartered Accountants who provide external and internal audit services, respectively.

HOW THE FUND WORKS

CLAIMS

∙ Application for compensation

Any eligible protected investor who wishes to make a claim for compensation must lodge an application for compensation with the Fund Administrator, Comarton Consultants (Private) Limited. In the event of insolvency of a contributor, the Board will publish a notice in at least two newspapers with national circulation and will send a claim form to each customer of the contributor based on the records of the contributor. A protected investor will have to submit a claim form to the Board before the deadline specified on the form and if he or she fails to do so, the Board may:

- extend the time within which a protected investor can file the claim; or ii. direct that he or she shall not be paid any compensation.

∙ Maximum amount of compensation

The maximum amount of compensation paid out at any one time does not exceed ten percent of the market value of the Fund’s assets at the time the payments become due. In the event of multiple claims the amount paid to each protected investor will be reduced proportionately.

∙ Determination of application for compensation

The claimant must provide proof to the Board that they suffered a loss and the loss was as a direct result of malpractice on the part of the contributor or of the insolvency of the contributor. Upon receipt of the documents the Board will submit them to SECZ for further investigations. Upon completion of investigations, SECZ will provide a report of its findings to the Board for evaluation and judgment. If the Board finds the claim valid, the Board will assess the amount of compensation payable and will settle the payment within three months. In the event of multiple claims emanating from a common contributor the Board will only make an assessment when all claims have been submitted.

∙ Rejection of application for compensation

An application for compensation will be rejected by the Board if:

- it is made twelve months after the malpractice or insolvency unless there is a valid explanation for the delay; or

- the protected investor is responsible for his or her loss; and

- the claim is found to contain inaccuracies or omissions unless the inaccuracies or omissions are not material and not meant to conceal information that would affect the Board’s decision.

The Board may postpone paying compensation where:

- it considers that the protected investor has not fully exhausted compensation from the contributor or other third parties; or

- the protected investor has been indicted with an offence arising from any business with the contributor from which the protected investor has benefited from its involvement and the court is yet to make a judgment.